About 50 years ago, in September 1970, Nobel prize-winning economist Milton Friedman took to the editorial pages of The New York Times to denounce the very notion of “social responsibility” as an appropriate consideration in corporate governance and management. He famously declared that the only social responsibility of a corporation is “to increase its profits.” Friedman saw nothing wrong with corporate leaders supporting various social causes as individuals. But the concept of “corporate social responsibility” was more than just wrong-headed, Friedman argued, it was “hypocritical window-dressing” that “harms the foundation of a free society.” He didn’t see how the concept could be squared with the obligation of management to do what’s best for shareholders, nor did he see how it could evolve to become a widely-accepted approach to investing.

What would Friedman think of the world today in which there’s an estimated $715 billion in the impact investing market and 86% of the S&P 500 Index® companies are publishing sustainability reports? How would he respond to reports that ESG funds have seen stable returns through this spring’s market swings? And, what would he say to CEOs who have shown great leadership over the past six months by launching new initiatives to address issues caused by COVID-19 and social injustice in this country? Andrew Ross Sorkin begged some of these questions in a recent article from The New York Times.

The Rise of ESG: Defining its Role Within Corporate Planning

It is hard to believe that the three-letter formulation “ESG” – for Environmental, Social and Governance – has been around for less than a generation. The phrase harkens back to a meeting of 50 CEOs of leading financial institutions convened in 2004 by UN Secretary General Kofi Annan in Zurich. One year later, as a result of that meeting, a report established the three letters as shorthand for what has become a powerful and enduring concept. It argued that integrating ESG principles into global capital markets made good business sense and would help societies confront the growing challenges of globalization and climate change.

ESG fit well into long-tenured movements such as “corporate social responsibility,” “socially responsible investing,” and “sustainable investing” – all approaches driven initially by large public employee pension funds. But the birth of ESG began a process of integrating those principles into capital markets, corporate strategies and organizational culture in new ways.

The essence of the change: ESG did not mean accepting an economic burden or a “tax” on profits or investment returns as a necessary consequence of “doing good,” as critics contended. Nor was it viewed in terms of traditional government social policy. Instead, the ESG vision was to creatively harness capital markets and corporations’ inherent drive to grow and maximize profits in the service of improving society.

Looking back, the CEOs who attended that 2004 meeting may be surprised today by how much of that vision has become reality. Events in recent months and years have accelerated the adoption of ESG in ways that would not likely have been foreseen at the time of the Zurich meeting.

The Accelerated Urgency to Drive ESG

Today, the question for corporate leaders is not whether to address ESG, but how to keep pace with rapidly rising standards and expectations. Increased scrutiny from consumers, investors, business partners, employees, rating services and regulators has put business leaders on notice. Companies increasingly feel they can no longer afford to approach ESG with hesitation, or be held back by concerns about political fallout or fear of being caught in the crossfire of the culture wars.

No clearer example can be found in companies’ response to the public outcry and demonstrations following the deaths of George Floyd, Eric Garner, Ahmaud Arbery, Breonna Taylor, and countless other Black people. A surprisingly long list of CEOs appeared on CNBC to decry the tragic event of George Floyd’s murder and to support changes in the justice system. Many acknowledged that their own companies had not done enough and pledged to do better.

Corporate donations flooded into non-profit advocacy groups, and some companies started programs or increased funding for existing initiatives focused on their own internal diversity efforts or helping black-owned businesses. Scores of ads were generated to associate brands with support for social justice goals.

Brands deemed to be associated with racial stereotypes are being retired. Small steps, such as CVS Health ending the practice of storing “multicultural cosmetic products” in locked cases, communicated important changes in how major retailers are managing their brands and their relationships with consumers.

These responses took place, of course, against the backdrop of a pandemic that starkly displayed the disparate, severely negative impact on Black people and communities of color. Moreover, the pandemic forced many companies to engage with their customers more directly and personally – in terms of values – than ever before. Issues of customer and employee health, safety and trust quickly became the priorities, overshadowing concerns about political fallout and culture conflicts.

Skeptics may say these changes are the result of passions “of the moment.” They are looking for companies to back up their words with meaningful action. Those are fair concerns; but it’s worth looking at recent developments that suggest that ESG, as an influential element in business and finance, was gathering momentum well before the pandemic or demonstrations and that ESG adoption is likely to accelerate, not diminish.

Shifting ESG Mindset In the C-Suite and the Boardroom

In August 2019, Business Roundtable (BRT), a highly influential industry group with more than 180 U.S. major companies, announced that it had redefined the purpose of a corporation as “promoting an economy that serves all Americans.” That was a 180-degree reversal from every previous “purpose” definition that the Roundtable had issued annually since 1978, which all focused on shareholder primacy.

This redefinition of corporate purpose as a commitment to all stakeholders was endorsed by such high-profile business leaders as Jamie Dimon, Chairman and CEO of JPMorgan Chase & Co. and Chairman of BRT, and Alex Gorsky, Chairman of the Board and CEO of Johnson & Johnson and BRT Committee Chair.

In February of this year, just weeks before the pandemic exploded into U.S. headlines, Larry Fink, founder and CEO of BlackRock, alerted companies in his annual letter that his firm would be focusing even more heavily in investment decisions on companies’ sustainability policies and practices. Though some environmental activists scoff at BlackRock’s tendency to support management in annual proxy resolution votes, BlackRock’s sheer size means the firm is a top five shareholder in many of the S&P 500 Index companies. Its position offered significant support to members of the boards of directors who would like to see more information from their management team about the risks of climate change.

“Climate change is one of the greatest challenges facing the planet today,” he said, “and we believe businesses are an essential part of the solution.”

– Doug McMillion, President & CEO of Walmart

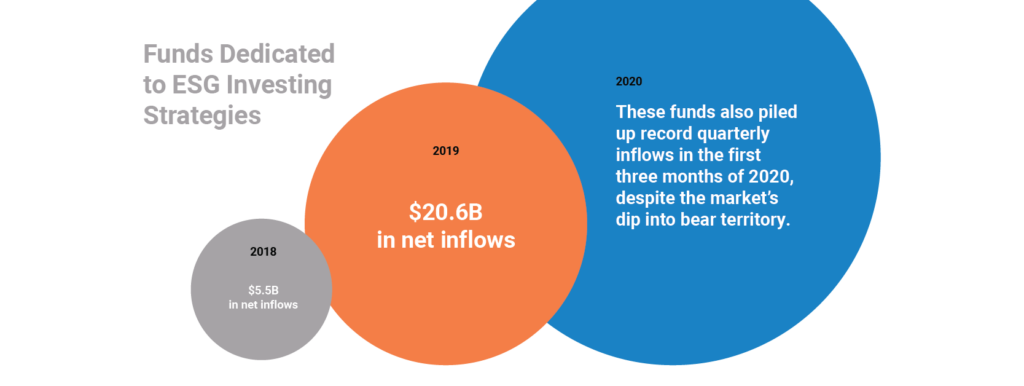

Fink’s letter came as ESG investment products seemed poised to achieve mainstream standing as a popular strategy. Morningstar reported that funds dedicated to ESG investing strategies pulled in $20.6 billion in net inflows in 2019, four times the inflows of 2018. These funds also piled up record quarterly inflows in the first three months of 2020, despite the market’s dip into bear territory.

Against the backdrop of the worst fires in history raging across California, Washington and Oregon, BRT came forward again recently, this time with a strong statement calling for ambitious action on climate change. A number of leading CEOs were quoted the BRT’s release, all echoing the sentiment from BRT’s chairman Doug McMillon, President & Chief Executive Officer of Walmart. “Climate change is one of the greatest challenges facing the planet today,” he said, “and we believe businesses are an essential part of the solution.”

Companies with High ESG Ratings are Being Rewarded in the Capital Markets

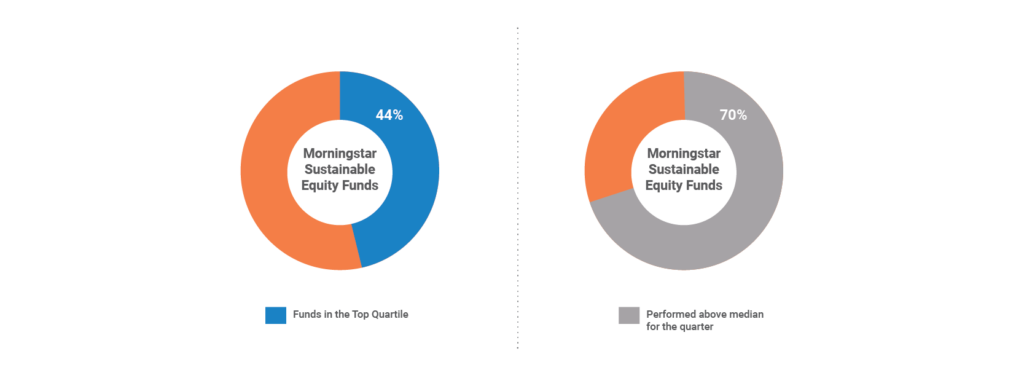

For some time now, companies have recognized that employees and customers, especially millennials, like to work at and buy from companies with a strong commitment to ESG. But now this is proving true in the capital markets as well. Also encouraging was ESG funds’ outperformance in the volatile first quarter of 2020. Morningstar data showed that 44% of all sustainable equity funds were in the top quartile of its broader equity fund universe and 70% performed above the median in the quarter.

Though ESG funds’ first quarter performance generally reflected their avoidance of energy stocks and high allocations to technology, their resilience as markets tipped into negative territory augurs well for continued investor interest. The ESG funds’ outperformance also helps refute the notion that socially responsible investing strategies means accepting sub–par returns.

This growth in ESG fund assets puts additional pressure on public companies to commit to ESG initiatives and communicate their progress. Companies are increasingly aware that institutional as well as private investors are now more likely to look to ESG data to make investment decisions. Subpar ESG rankings could mean that a company’s stock is less likely to be in the consideration set for the growing pool of investment funds using ESG strategies, which in turn could impact a company’s valuation.

Some frustration can be found in executive suites and boardrooms about the challenges of managing these third-party assessments and the proliferation of ESG data that is being used to rank their companies. Rating agency protocols vary widely, making a company’s task of improving its ESG scores more daunting. Corporate leaders sometimes question whether the metrics used by the rating agencies are actually material to their organizations’ performance.

Those concerns aside, more rigorous, coherent ESG metrics are coming forward as shareholders and advocacy group press their case with CEOs and boardrooms. A sign of change has come in this year’s proxy season, which saw seven shareholder resolutions calling on companies to comply with ESG reporting standards set by the Sustainability Accounting Standards Board (SASB).

We worked with SASB in the early days when it was formed in 2011 by Jean Rogers, who originated the concept to develop standards for use in corporate filings to the U.S. Securities and Exchange Commission (SEC). The standards were designed to address financially material aspects of corporate sustainability activity. This year, large investment advisors have finally committed to using SASB standards, with BlackRock and State Street Global Advisors announcing in January that they would use SASB disclosures to inform their proxy voting policies.

The fates of the seven resolutions are worth noting. Three of the seven resolutions drew overwhelming shareholder support, with approval votes of 61%, 66%, and 79%. Two resolutions received the commitment of the targeted companies to comply and were withdrawn. A sixth was implemented after a shareholder vote of only 11%. The seventh was withdrawn because of a technical flaw.

Those shareholder votes are just one of myriad signs of what looks like an increasingly broad acceptance of ESG as having an important role in addressing the problems that societies and the economy confront. Not surprisingly, a growing number of CEOs see their companies as having a big stake in how those challenges are resolved.

“The American dream is alive, but fraying. Major employers are investing in their workers and communities because they know it is the only way to be successful over the long term.”

– Jamie Dimon, JPMorgan CEO and Chairman

“The American dream is alive, but fraying,” warned JPMorgan CEO and Chairman Jamie Dimon in the Business Roundtable announcement last August. “Major employers are investing in their workers and communities because they know it is the only way to be successful over the long term.”

Looking at The Path Forward

Corporations are continuing to adopt ESG principles and the concept of a “purpose-driven” business at a faster pace than expected, a development that surely would have dismayed Friedman and his followers.

Through purpose-driven approaches, CEOs, their management teams, and their boards see opportunities to provide incredible value to all of their stakeholders, enabling them to give employees a meaningful context for their work. It will allow them to differentiate their brands, and to motivate and retain their customers. It will provide opportunities to align their values with those who influence their customers’ behavior and with key business partners throughout distribution channels. And finally, it will enable them to deliver superior returns to their investors while simultaneously providing a vehicle for bringing about much needed change.

We believe that we are at a tipping point and that a new generation of management has largely endorsed the view that it’s right and proper for a company to consider its impact on society for all of its stakeholders.

Stay tuned for additional ESG updates, as we dig into the recent rise of the S of ESG, how RF|Binder approaches ESG strategies for clients, and more.