Until recently, the main challenge to marketing ESG funds came in convincing investors that that they could “do good while doing well.” Much of the market needed persuading that a fund focused on values could match the performance of its generalist peers.

That’s no longer the case. Demand has exploded and with that explosion has come backlash. States including Texas and Florida have passed anti-ESG policies. More may follow.

These policies, along with backlash to greenwashing, might lead ESG marketers to believe that a general negative view is overtaking the space. Our research finds that this isn’t so.

Our integrated communications firm has worked with a wide variety of ESG focused managers, including some of the founders of the space, so this issue was of major interest for our team. To get a better sense of what communicators should be doing today, we took a look at coverage of ESG related issues at 10 national top tier publications over the past year.

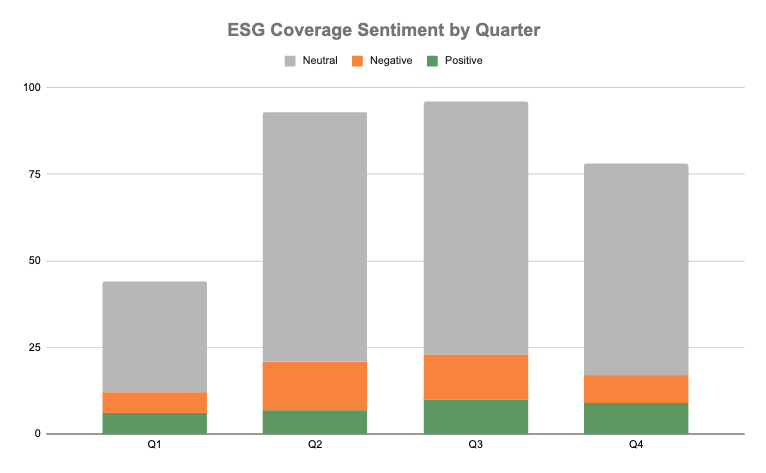

1. While critical ESG news content has grown more evident, overall coverage in leading media outlets remains largely positive or neutral. Positive and negative pieces hold a comparable share of total coverage. Most coverage is funds focused: launches, strategies, and performance.

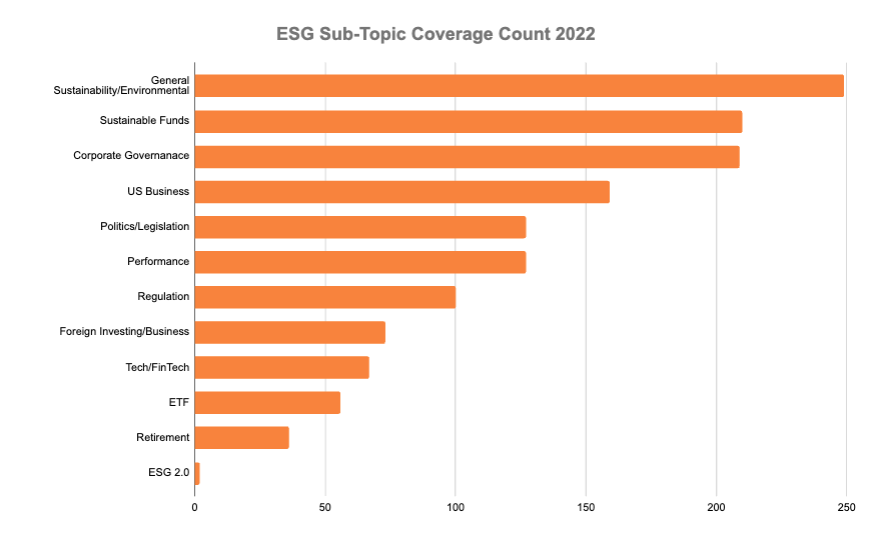

2. Political backlash still lags funds coverage – In fact, general sustainability stories, those focused on governance, and those focused on the industry all outpaced political content over the past year. Political stories may be louder than those focused on finance, but they’re less frequent.

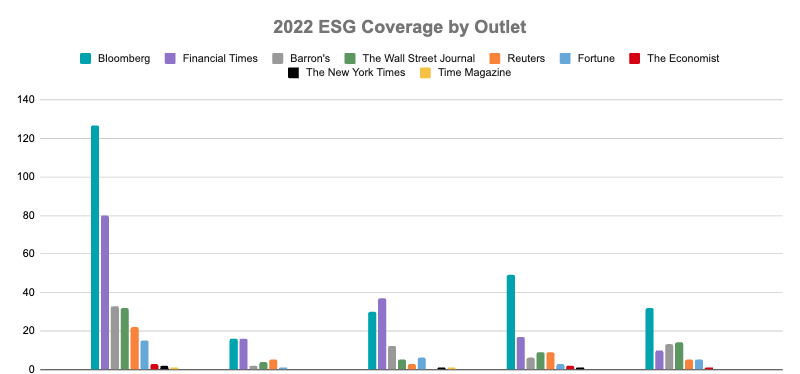

3. Financial publications are leading the way – The Financial Times and Bloomberg have expanded their ESG staff over the past few years with hires to the Green and Moral Money teams, so it’s unsurprising that they’re generating the most coverage. Their reporting spans a variety of topics but generally targets a business and investor audience.

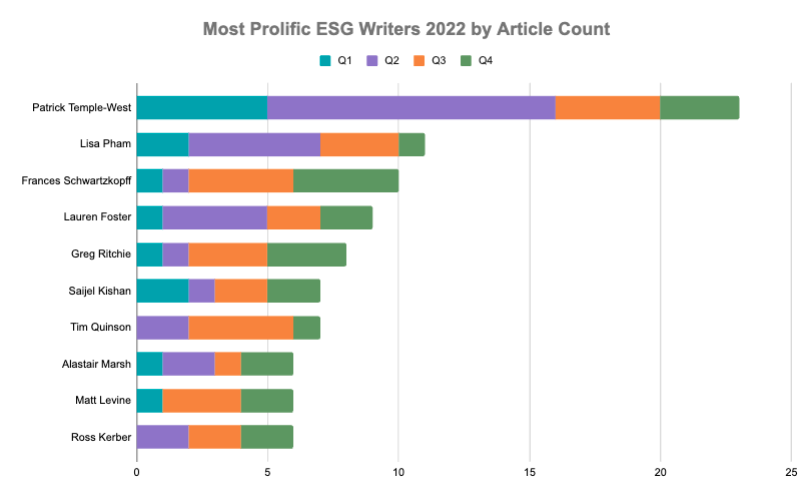

4. The FT’s Temple-West is the space’s most prolific writer – At least over the past year, Moral Money’s Patrick Temple-West published far more than anyone else in our survey on ESG related topics. Moral Money doesn’t shy away from politics but it’s down the middle reporting certainly doesn’t skew negative on ESG.

A note: Our survey is simply taking the pulse of media coverage. While negative coverage of ESG investing may not be as widespread as some think, we don’t know for sure the impact it may be having on institutional investors or distribution channels such a financial advisors and brokers.